Just A Little Bit of History Repeating

Posted on .As we approach the end of 2013 I am feeling a little anxious. If you are a gambler you might know the feeling, it is the same sense you get during a good run. The dice are hot and the numbers keep coming. Like a good sport you keep pressing. But at some point you look up and see that you have an uncomfortable amount of money on the table.

At holiday parties my VC friends keep asking the same question – is it 1999 or 1997? How much time do we have left on this bull market? If you are a young partner at a venture capital firm this is not an academic question because almost all of your net worth is tied up in start-up stocks.

The good news is that I think we have at least another year. There is even an outside chance that the market could get hotter. The big unknown is how the market will react once the Fed stops stimulus spending next year.

In hindsight, this all started with the financial crisis. The Fed lowered interest rates to zero, and like many investors I moved money out of my zero-return bank account and into investment-grade bond funds. The yields on those funds quickly went to zero because everyone else was doing the exact same thing, so I moved money into riskier bond funds. The yield on those funds went down too. After that I put money into equities.

As they say, “You can’t fight the Fed.”

The S&P 500 was up 23% in 2013. Many people predicted that would happen. But who would have guessed that Best Buy would be the third best performing stock this year, up 230%? The market is willing to overlook that Best Buy is shrinking, losing money, and every comparable company (Circuit City, CompUSA, Tweeter, etc) went bankrupt. Similarly, many of the hot IPOs this year never made a profit before going public. So much for the axiom about “four consecutive quarters of profitability ahead of an IPO”. That just didn’t matter in 2013.

This is the hazard of Fed stimulus. Returns flatten out on safe investments, encouraging investors to take more risk.

If you are an institutional investor sitting on the sidelines, 2013 must have been a painful year. Even if you are right in the long run about the value of equities, you under-performed the market by a lot in 2013.

The reason I am bullish about 2014 is that the Fed inadvertently created a pressure cooker. Money managers can’t afford to have two bad years in a row – that means they lose their job – so they will take more risk in 2014. Maybe they invest in some IPOs. Maybe they dip into the private markets, putting money into “Pre-IPO” growth companies.

This is where it starts to get interesting for VCs like me.

The amount of money on the sidelines today dwarfs the markets from the 1990s. McKinsey wrote a report in August of 2011 that showed the global financial markets grew by $100 Trillion since 2000, to a total of $212 Trillion, and almost all the growth was in the public and private debt markets. All it takes is a few investors to make small adjustments, maybe take a little more risk in 2014, and the good times come again.

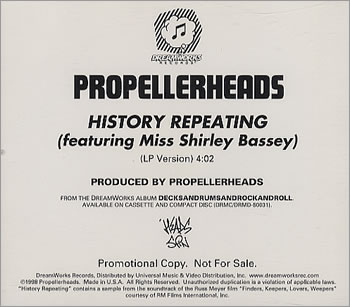

It is just a little bit of history repeating.

Ian Sigalow

http://sigalow.comIan is a co-founder and partner at Greycroft Partners in New York City. He has been a venture capitalist since 2001.

AUTHOR fs2117

Posted on 6:42 pm December 23, 2013.

Ian – curious to know what lens you are looking at this through? Public market investor, private market, hybrid of the two? I get that for better or worse, there are systemic relationships between the private and public markets, but as you move down the spectrum of company life-cycle (as it relates to investing), isn’t an investor reducing his correlation/dependency risk to the public markets, assuming fundraising is in check? In other words, pending some sort of Black Swan 2008-esque event, isn’t the fluctuation of the public markets over a 1-2 year period fairly irrelevant to an early-stage investor?